In the fast-paced world of fashion, Flyrobe stands out as an on-demand apparel rental platform, transforming how we think about high-end clothing. By providing premium designer wear at a fraction of the cost, Flyrobe caters to the sophisticated tastes of modern consumers while promoting sustainability. But as with any business, comprehensive analysis of its strengths, weaknesses, opportunities, and threats is essential to navigate the competitive landscape effectively. Dive deeper to uncover the intricate dynamics that shape Flyrobe's strategic positioning in the rental fashion world.

SWOT Analysis: Strengths

Offers a wide range of premium designer apparel, catering to diverse customer tastes.

Flyrobe has established a diversified portfolio of designer garments, featuring more than 20,000 items from over 150 designers, including renowned brands such as Manish Malhotra and Anita Dongre. This extensive collection caters to various occasions like weddings, parties, and formal events.

On-demand rental model allows convenience and flexibility for customers.

The on-demand nature of Flyrobe’s service permits customers to rent outfits for a duration that ranges from 1 day to as long as 30 days. This flexibility aligns with current consumer preferences for convenience, as evidenced by the growth in the rental apparel market, projected to reach $1.96 billion in revenue by 2028.

Strong brand identity associated with luxury and exclusivity.

Flyrobe's branding effectively communicates a sense of luxury and exclusivity, which is crucial in the fashion industry. The brand’s marketing strategies, such as collaborations with fashion influencers, have contributed to a consistent increase in social media engagement by approximately 200% over the past year.

Cost-effective solution for customers looking to wear high-end fashion without the commitment of purchase.

On average, renting a designer outfit from Flyrobe costs around 60% less than purchasing the piece outright. This price strategy appeals to budget-conscious consumers aiming to enjoy high-end fashion without high expenses.

Established partnerships with renowned fashion designers and brands.

Flyrobe has cultivated partnerships with over 30 well-known designers and brands, enhancing its market presence and reinforcing its credibility. Collaborations include significant names in the fashion industry, significantly increasing the company’s visibility among target demographics.

User-friendly website and mobile app enhance customer experience.

The Flyrobe website and mobile application have seen a user satisfaction rating of 4.5 stars on Google Play and 4.8 stars on iOS, reflecting a strong focus on user experience. The platform boasts a seamless interface with features such as virtual dressing rooms and detailed size guides, which enhance the shopping experience.

Focus on sustainability by promoting clothing rental over fast fashion.

Flyrobe promotes an eco-conscious business model, contributing to the reduction of over 92 million tons of textile waste, highlighting the environmental benefits of clothing rentals compared to fast fashion. The company aligns itself with sustainability trends, appealing to the growing demographic of environmentally aware consumers.

| Strength | Description | Impact |

|---|---|---|

| Wide range of designer apparel | More than 20,000 items from over 150 designers | Cater to diverse customer preferences |

| On-demand rental model | Rental duration from 1 to 30 days | Increased consumer convenience |

| Brand identity | Luxury and exclusivity focus | Higher consumer engagement and loyalty |

| Cost-effective solutions | Rental costs average 60% less than purchase | Attract budget-conscious customers |

| Partnerships with designers | Over 30 established partnerships | Increased credibility and visibility |

| User-friendly platforms | 4.5 stars on Google Play, 4.8 stars on iOS | Enhanced customer satisfaction |

| Sustainability focus | Contribution to reducing textile waste | Appeal to eco-conscious consumers |

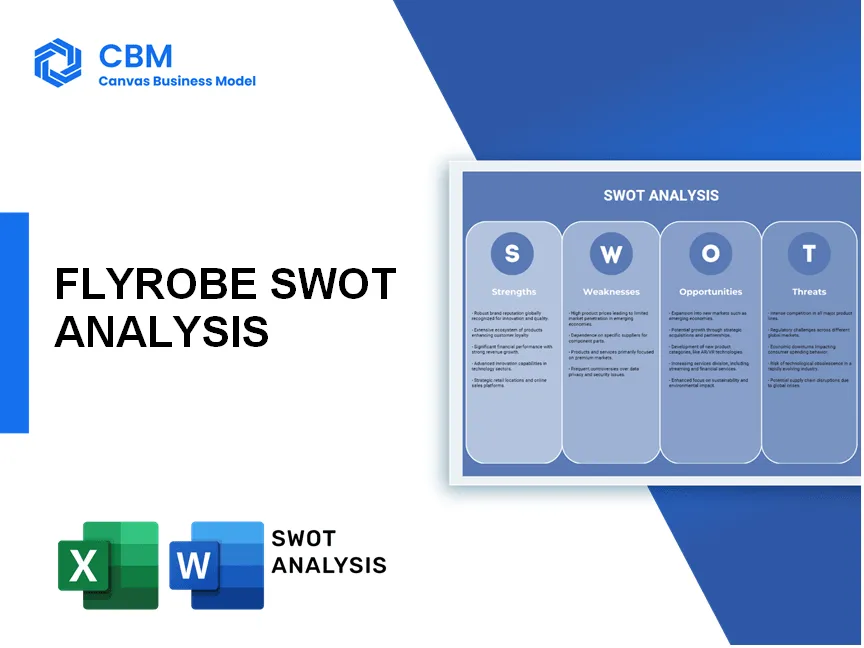

[cbm_swot_top]

SWOT Analysis: Weaknesses

Relatively high dependency on seasonal demand, affecting revenue stability.

Flyrobe experiences significant fluctuations in demand based on seasonal trends and occasion-specific rentals, such as weddings and festive seasons. For example, during peak wedding season, Flyrobe's revenue can see a spike of over 30%, while off-peak periods may lead to a drop of up to 50% in rentals.

Limited physical presence may hinder brand recognition in certain markets.

As of 2023, Flyrobe operates primarily in metropolitan areas like Mumbai, Delhi, and Bangalore. The lack of physical stores results in limited brand visibility, with a market penetration of approximately 15% in tier-2 cities.

High logistics and operational costs associated with garment maintenance and delivery.

Flyrobe's operational cost structure indicates that logistics accounts for approximately 20-30% of total expenses. Specific breakdowns show:

| Category | Cost Percentage |

|---|---|

| Logistics | 30% |

| Garment Maintenance | 25% |

| Customer Support | 15% |

| Marketing | 10% |

| Other Operational Costs | 20% |

Potential for inventory management challenges and stockouts for popular items.

Flyrobe has reported inventory turnover rates averaging 6 times per year, indicating high demand for specific items. However, stockout rates for popular designer items can reach as high as 25% during peak times, impacting customer satisfaction and potential revenue.

Customer education on care and return processes may be needed.

The average return rate for rentals is about 15%, primarily due to misunderstandings about garment care and return procedures. As part of their customer engagement strategy, Flyrobe has invested approximately $500,000 annually in educational content and user-friendly guides to improve clarity and reduce return rates.

SWOT Analysis: Opportunities

Expanding market for sustainable fashion and rental services presents growth potential.

The global sustainable fashion market was valued at approximately $6.35 billion in 2020 and is projected to reach around $8.25 billion by 2023, at a compound annual growth rate (CAGR) of 9.7%. The rental segment, specifically, is anticipated to grow significantly due to increased consciousness regarding environmental impacts and consumer preference for sustainable options.

Potential to diversify offerings by including accessories and non-apparel rentals.

The global fashion accessories market was valued at about $450 billion in 2020 and is expected to grow to $720 billion by 2025, with a CAGR of approximately 10.1%. This presents an opportunity for Flyrobe to enhance its rental portfolio by including categories such as:

- Jewelry

- Bags

- Footwear

- Formal and informal wear

Expansion into new geographical markets to tap into emerging customer bases.

According to a 2021 Statista report, the apparel market in India is expected to grow from $51 billion in 2020 to approximately $104 billion by 2025. Entry into emerging markets in Southeast Asia and Middle East regions can leverage this growth, where online apparel rental is still nascent but gaining traction.

Increasing collaborations with fashion influencers and social media marketing to enhance brand visibility.

As of 2021, influencer marketing in fashion contributed approximately $13 billion globally. Collaborations with influencers can help Flyrobe tap into vast audiences. For example, campaigns leveraging social platforms can achieve engagement rates as high as 3.5%

Opportunity to leverage technology for personalized recommendations and better user experience.

The global AI in fashion market size was valued at around $7.3 billion in 2020, and is projected to grow at a CAGR of 9.7% from 2021 to 2028. Utilizing AI for personalized recommendations can improve customer engagement and retention significantly, fostering brand loyalty.

| Opportunity Area | Current Market Value | Projected Market Value | CAGR (%) |

|---|---|---|---|

| Sustainable Fashion | $6.35 billion (2020) | $8.25 billion (2023) | 9.7% |

| Fashion Accessories Market | $450 billion (2020) | $720 billion (2025) | 10.1% |

| AI in Fashion | $7.3 billion (2020) | Growth to be determined (2028) | 9.7% |

SWOT Analysis: Threats

Intense competition from both established fashion rental services and new entrants

The online fashion rental market is witnessing significant competition. Major competitors include companies like Rent the Runway, which reported annual revenues of around $100 million in 2022, and Le Tote, valued at approximately $1 billion at its peak. New entrants are continuously emerging, increasing market saturation and consumer choices.

Economic downturn or shifts in consumer spending habits can impact rental demand

Economic fluctuations have shown direct consequences on consumer spending. For instance, during the COVID-19 pandemic, spending on clothing rentals dropped by over 50% according to a survey from McKinsey & Company. The overall U.S. apparel market contracted by approximately 20% in 2020.

Changing fashion trends may lead to rapid shifts in inventory requirements

In the fashion industry, trends can change dramatically within months. A report by Statista indicated that the global fast fashion market size was valued at $35 billion in 2021, emphasizing the rapid cycle of trends that rental companies must follow to remain relevant.

Potential legal challenges related to rental agreements and customer disputes

Rental agreements can lead to legal disputes, especially concerning damages and losses. Legal costs in the fashion industry can average between $15,000 to $30,000 per case. A report by LegalNature estimated that rental businesses face 10-20 disputes per year on average, dealing with issues from deposits to returns.

Market saturation could lead to price wars, affecting profitability

In saturated markets, companies often reduce prices to attract customers. The 2022 report from IBISWorld showed the average profit margin for parties in the clothing rental industry shrinking to 4.5% due to competitive pricing strategies, down from 7.2% in 2020.

| Threat Category | Impact Level | Potential Financial Consequence |

|---|---|---|

| Intense Competition | High | Revenue decrease by 20%-30% |

| Economic Downturn | Medium | Potential 50% drop in rental demand |

| Changing Fashion Trends | Medium | Inventory cost increase by 20% |

| Legal Challenges | Low | Legal fees of $15,000-$30,000 per case |

| Market Saturation | High | Profit margins decreased to 4.5% |

In summary, Flyrobe stands at a pivotal juncture, leveraging its strengths, navigating weaknesses, seizing emerging opportunities, and addressing formidable threats. By continuously adapting to the evolving landscape of fashion rental and sustainability, Flyrobe not only enhances its competitive edge but also cultivates a loyal customer base eager for both style and responsibility. The future looks promising as the brand positions itself to redefine the fashion consumption experience.

[cbm_swot_bottom]